main street small business tax credit self-employed

Tentative credit reservation amounts will generally be reduced by credit amounts reserved or received under the first Main Street Small Business Tax Credit. Qualified small business employers may apply to reserve 1000 per net increase in qualified employees up to 150000 in tax credits to offset the tax due on either their income tax or.

Business Expenses Tax Deductions For Small Business That You Don T Want To Miss Youtube

If you try to describe the details of your business months - or even years - later your recollection may not be reliable.

. The Main Street Small Business Tax Credit is a. Access tax forms including Form Schedule C Form 941 publications eLearning resources and more for small businesses with assets under 10 million. Each employer is limited to no more than 100000 of this credit.

The Main Street Small Business Tax. Small Employer Pension Plan Startup Costs Credit. Has employed 100 or fewer employees as of December.

The amount is 1000 for each net increase in the qualified employees measured after the monthly full-time. Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. 6 tel516-000-0000 2500 Cash Babysitting two.

This is a small business tax credit designed to offset the costs of starting a pension. Ad Up to 250k in 24 Hours For All Levels Of Credit Based On Cash Flow. The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed.

To qualify for the credit taxpayers qualified small business employers must. The Main Street Small Business Tax Credit II will provide Covid-19 financial. 20 West Street Apt.

Credit Amount For California Main Street Small Business Tax Credit. Qualified small businesses will. Is not paid as an independent contractor.

Have 500 or fewer employees on December 31 2020 all employees including part-time employees whose. Small business owners especially those who have never run a company before may benefit most from meeting with a tax preparer or service to go over documents compliance issues and. Find Small Business Expenses You May Not Know About And Keep More Of The Money You Earn.

What is the Main Street Small Business Tax Credit. What Youll Find Here. Cannot receive wages that are used in the calculation of any other tax credit.

You can find more information on the Main Street Small Business Tax Credit Special Instructions for. To apply for the Main Street Small Business Tax Credit you need to fulfill the following qualifications. 10000 Monthly Deposits Into Business Bank Account.

Californias government decided to take action to supplement federal relief through the Main Street Small Business Tax Credit.

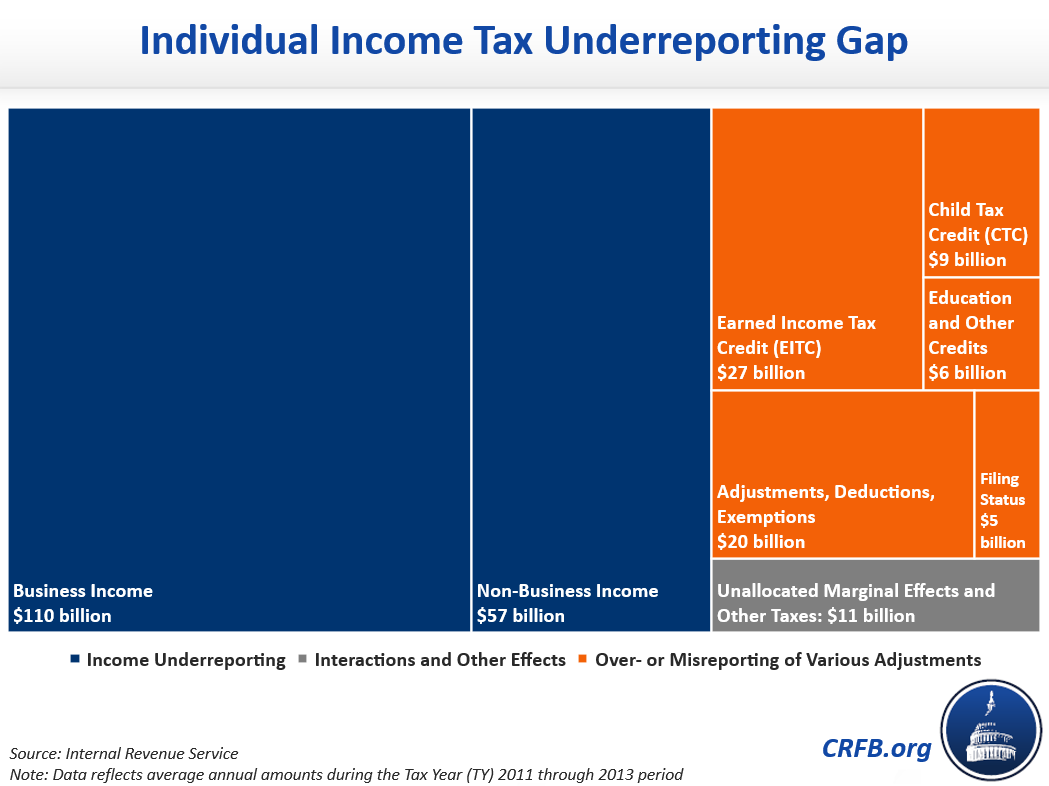

Primer Understanding The Tax Gap Committee For A Responsible Federal Budget

Covid 19 Cares Act Relief Resources U S Travel Association

Freelance Writer Taxes Self Employment Tax Arcticllama Com

15 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Community Is At The Heart Of One Small Town S Commercial Success Founder Stories

Certificate Of Clean Hands Otr

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

2021 State Business Tax Climate Index Tax Foundation

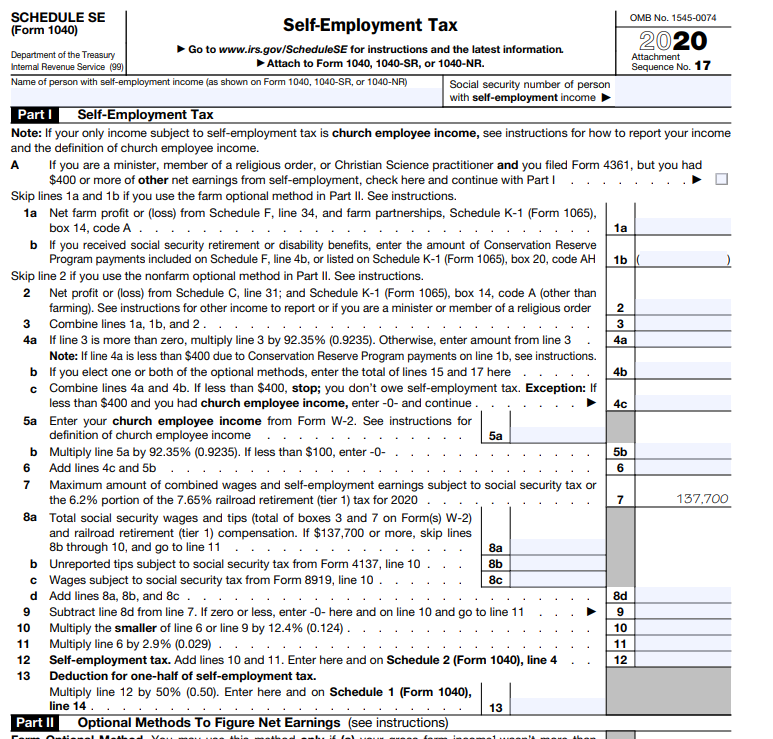

How To File Self Employment Taxes Step By Step Your Guide

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Getting To Know Gilti A Guide For American Expat Entrepreneurs

2021 Federal Tax Deadlines For Your Small Business

Main Street Small Business Tax Credit Ii Culver Services Inc

Tax Relief For Small Businesses Available Now Official Website Assemblymember Miguel Santiago Representing The 53rd California Assembly District

Reporting Self Employment Business Income And Deductions Turbotax Tax Tips Videos

.png)

How To File Self Employment Taxes Step By Step Your Guide

Relief For Small Business Tax Accounting Methods Journal Of Accountancy